Bankruptcy FAQ's

Top Bankruptcy Attorneys and Home Foreclosure Defense Attorneys.

Over 750 ★★★★★ Google Reviews

Contact Our Attorneys Today

EVALUATION

At Sadek Bankruptcy Law Offices, we realize that every situation is different. Our debt relief lawyers will take the time to learn about your situation and your goals. Our objective is to explain your legal options and offer the best debt relief strategy for you in the most compassionate and friendly manner possible. Call 24/7 to schedule your meeting with a lawyer.

AVAILABLE

Our office understands the financial stress our clients endure. Therefore, in addition to reasonable legal fees, we offer a payment plan to all of our valued clients to make quality legal services most affordable.

AND NJ

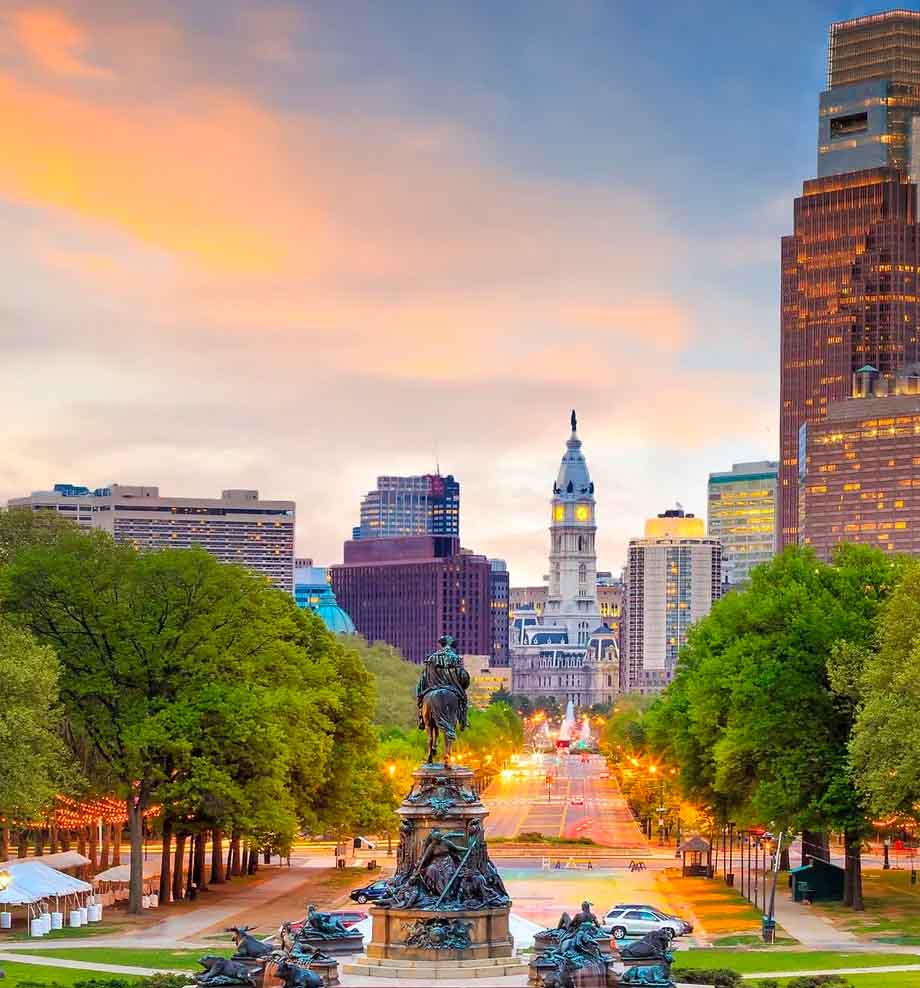

In addition to our primary law office in Center City, Philadelphia, we also have law offices throughout the Greater Philadelphia, Pennsylvania Area and in New Jersey. Our branch offices have contributed to making us the #1 Bankruptcy Filer and debt relief firm in the Greater Philadelphia area. Our goal is to have a convenient location within 20 minutes of where our clients work or reside.

Bankruptcy FAQ’s

The following information includes frequently asked questions about bankruptcy. The answers stated are general in nature and are not intended to apply to every bankruptcy and/or debt consolidation situation.

If you require assistance with personal or business bankruptcy filing and require the assistance of an experienced bankruptcy lawyer in Allentown or Philadelphia, Pennsylvania, or within the surrounding counties of Montgomery, Bucks, Chester, Delaware Counties and Southern New Jersey.

Please contact the lawyers of Sadek Bankruptcy Law Offices today at (215)-545-0008. We provide a FREE consultation with an experienced Allentown or Philadelphia debt-relief lawyer. For a brief introduction to a number of common bankruptcy concerns, please browse the questions below for additional information.

- What is bankruptcy?

- What can bankruptcy do for me?

- What different types of bankruptcy cases should I consider?

- What is Chapter 7 (straight bankruptcy)?

- What is Chapter 13 (reorganization)?

- Can I own anything after bankruptcy?

- Will I have to go to court?

- Will bankruptcy affect my credit?

- What else should I know?

What is Bankruptcy?

Bankruptcy is a legal proceeding through which a person who cannot pay his or her bills can get a fresh financial start. The right to file for bankruptcy is largely defined by federal law, although Pennsylvania and all state introduce some unique elements to proceedings. Furthermore, all bankruptcy cases are filed and handled in federal court.

Upon filing your bankruptcy petition with the court, the automatic stay will go into effect and all of your creditors will be immediately stopped from seeking to collect debts from you — at least until your debts are sorted out according to the law under the U.S. Bankruptcy Code.

What Can Bankruptcy Do For Me?

For many people, bankruptcy is a pathway to a fresh financial start. Bankruptcy can allow a filer to:

- Discharge or wipe away the vast majority of your debt.

- Protect your home from foreclosure and provide additional time to catch-up on the payments for the mortgage.

- Protects property by preventing the repossession of a car or other property. Bankruptcy law can also allow the filer the right to redemption by or forcing the creditor to return property even after it has been repossessed.

- Stops wage garnishments

- Ends debt collection harassment and similar creditor actions to collect a debt through the automatic stay.

- Restore or prevent the termination of a utility service such as heat, water, or electricity.

- Allow you to challenge the claims of creditors who have committed fraud or who are otherwise trying to collect more than you really owe.

What Different Types of Bankruptcy Cases Should I Consider?

There are four main types of bankruptcy available under the U.S. Bankruptcy Code. These forms of bankruptcy are:

- Chapter 7 bankruptcy which is sometimes referred to as “straight” bankruptcy or “liquidation.” Through “liquidation” a bankruptcy filer can seek the discharge of unsecured debts, including but not limited to credit cards, personal loans, medical bills, judgments, past due utilities and other debts.

- Chapter 11 is sometimes described as a “reorganization.” This form of bankruptcy is used by businesses and a few individual debtors whose debts are very large or their finances are particularly complex.

- Chapter 12 is reserved for family farmers and fisherman.

- Chapter 13 is termed a “debt adjustment” or a “wage earners’ plan.” It requires a debtor to file a three to five year plan to repay debts (or parts of debts) from a current source of income. The plan can provide additional time to catch-up on unpaid debts.

Most people will file for bankruptcy under either chapter 7 or chapter 13. Either type of case may be filed individually or by a married couple filing jointly.

What is Chapter 7 (Straight Bankruptcy)?

In a bankruptcy case under Chapter 7, you file a petition asking the court to discharge your debts. The goal of a Chapter 7 Bankruptcy filing is to eliminate the maximum amount of debt in exchange for you giving up property.

However, you will not lose all of your property because you can keep “exempt” property. In many cases, all of your property will be exempt. However, property which is not exempt is sold, with the money distributed to creditors.

If you want to keep property like a home or a car and are behind on the payments on a mortgage or car loan, a Chapter 7 bankruptcy probably will not be the right choice for you. That is because Chapter 7 bankruptcy property protections are not as strong as those provided by Chapter 13 bankruptcy.

What is Chapter 13 (Reorganization)?

In a Chapter 13 bankruptcy plan, the filer will submit a three to five year plan showing how he or she will pay off some of your past-due and current debts.

The most important thing about a Chapter 13 case is that it will allow you to keep valuable property- especially your home and car which might otherwise be lost, if you can make the payments which the bankruptcy law requires to be made to your creditors.

In most cases, these payments will be at least as much as your regular monthly payments on your mortgage or car loan, with some extra payment to get caught up on the amount you have fallen behind.

You should consider filing a chapter 13 plan if you:

- Own your home and are in danger of losing it because of money problems;

- Are behind on debt payments, but can catch up if given some time;

- Have valuable property which is not exempt, but you can afford to pay creditors from your income over time.

You will need to have enough income in chapter 13 to pay for your necessities and to keep up with the required payments as they come due.

Can I Own Anything After Bankruptcy?

Yes, you can own property after a bankruptcy. Many people believe that they will be left bereft of any worldly possessions after a bankruptcy case. This is not true. You can keep your exempt property and anything you obtain after the bankruptcy is filed.

However, if you receive an inheritance, a property settlement, or life insurance benefits within 180 days after filing for bankruptcy, that money or property may have to be paid to your creditors if the property or money is not exempt.

Will I Have to Go to Court?

In most bankruptcy cases, you only have to go to a proceeding called the “meeting of creditors” to meet with the bankruptcy trustee and any creditor who chooses to come. Most of the time, this meeting will be a short and simple procedure where you are asked a few questions about your bankruptcy forms and your financial situation.

Occasionally, if complications arise, or if you choose to dispute a debt, you may have to appear before a judge at a hearing. If you need to go to court, you will receive notice of the court date and time from the court and your attorney.

Will Bankruptcy Affect My Credit?

Yes, bankruptcy will almost certainly affect your credit negatively at the outset. However, if you are considering bankruptcy you are probably already under significant financial stress and are likely to have a low credit score. In the long term, bankruptcy will allow you to rebuild your credit.

What Else Should I Know about Bankruptcy?

A few more relevant concerns:

- Utility services: Public utilities, such as the electric company, cannot refuse or cut off service because you have filed for bankruptcy. However, the utility can require a deposit for future service and you do have to pay bills which arise after bankruptcy is filed.

- Discrimination: An employer or government agency can not discriminate against you because you have filed for bankruptcy.

- Driver’s license: If you lost your license solely because you could not pay court-ordered damages caused in an accident, bankruptcy will allow you to get your license back.

- Co-signers: If someone has co-signed a loan with you and you file for bankruptcy, the co-signer may have to pay your debt. If you file a Chapter 13 you may be able to protect co-signers, depending upon the terms of your Chapter 13 plan.